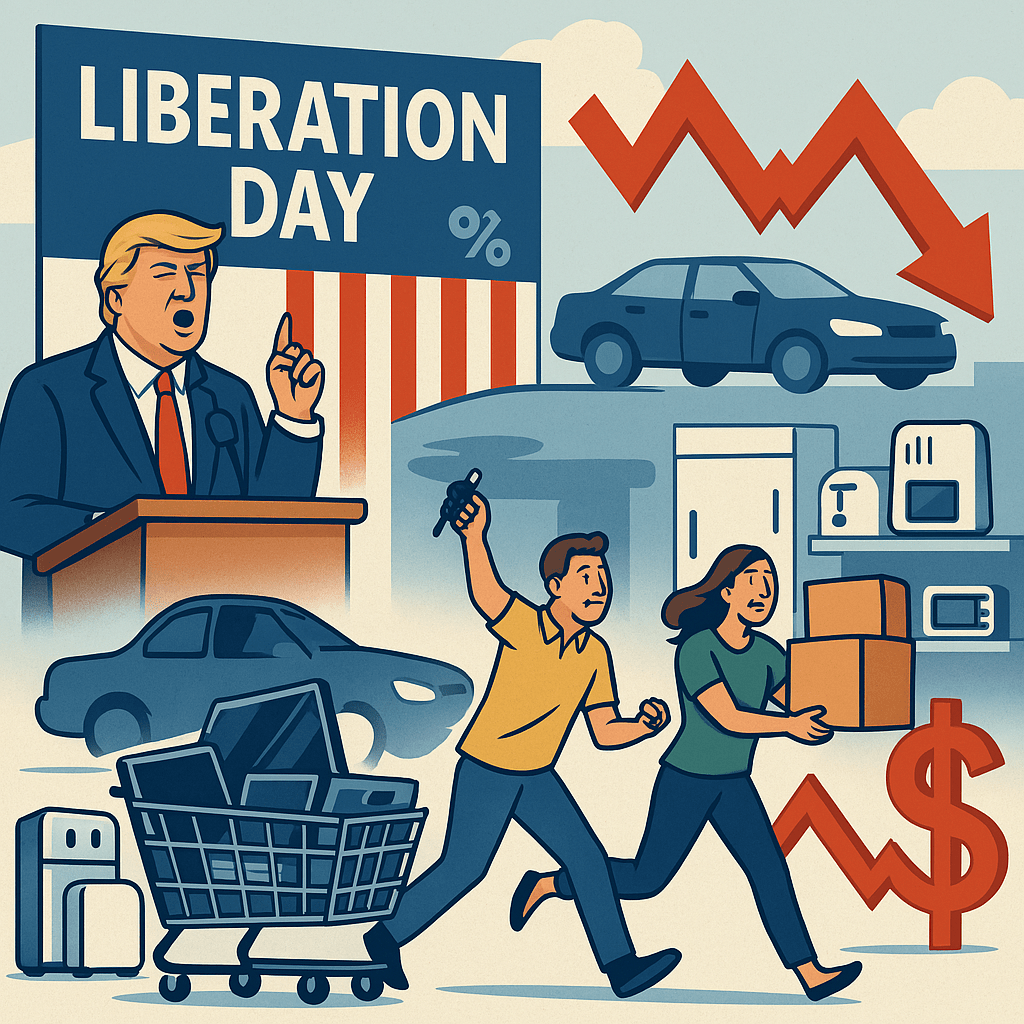

So, April 2nd, 2025. Liberation Day. President Trump took to the podium and declared that America is now free—from cheap imports, trade dependencies, and apparently, from stock market stability. Because by the time the markets were done reacting to his big tariff announcement, over 6 trillion dollars had left the building.

That’s not a typo. That’s not even a Tuesday typo. That’s two days of the market doing a dramatic fainting routine like a Victorian aristocrat who just spotted a scuffed teacup.

🚀 Tariffs: The Economic Pre-Workout You Didn’t Ask For

The plan? A 10% tariff on everything we import, with bonus rounds for China (up to 54% on certain goods). Think of it like America starting a CrossFit program for its economy: lots of sweat, occasional crying, and questionable results depending on your core strength.

President Trump called it an “economic revolution.” Economists called it… other things. Some unprintable.

Meanwhile, the American public has gone into full apocalypse-prepper mode—but make it retail.

🛒 BestBuy Blackout and the Great Car Grab of 2025

With rumors of price hikes looming, people are panic-buying like it’s Y2K and all the computers are going to explode. Again.

- Cars? Flying off the lots. Because if a Toyota Camry is going to cost 10% more next month, why not buy three now and store two in the garage for later like Costco chicken?

- Electronics? BestBuy is about to become JustBuy, because if you wait, there may not be anything left. TVs, laptops, smart fridges that tell you you’re out of oat milk—they’re all vanishing faster than a CEO’s tweets after a bad earnings call.

- Appliances? Word on the street is people are buying extra toasters. Not a toaster. Extra toasters. Because who knows—your 2025 Roth IRA may be down 20%, but that box of tariff-free KitchenAid mixers in your basement? Now that’s a diversified portfolio.

💸 Retirement Planning, but Make It Kitchenware

Forget index funds. The savvy investor in 2025 is hedging their bets with high-end Japanese rice cookers and espresso machines. I heard someone ask their financial advisor, “Should I convert some of my 401(k) into air fryers?”

And honestly? Not the worst idea.

If inflation kicks in and that imported espresso machine jumps from $199 to $299, you’ve just made a 50% return on your investment. Also, lattes for life. That’s a win-win.

😅 But Seriously, Folks…

Yes, the market is jittery. Yes, a full-on trade war could mess with prices, supply chains, and everyone’s mental health. But this isn’t the first time the world felt like it was turning upside down.

Remember 2008? Or 2020? Or every time your phone updates and you can’t find the flashlight anymore?

We’re built for this kind of chaos. We’ll adjust, adapt, meme through it, and eventually figure out what works. Tariffs might hurt in the short term, but who knows—maybe there’s a silver lining in building more things here. Like toasters. (Seriously, people are really into toasters right now.)

🙃 In the Meantime…

Let’s stay grounded, stay kind, and keep a little humor in the cart—because laughing is still free and not (yet) subject to a tariff.

And if you really want to hedge against the future? Maybe skip the lottery ticket and grab that extra phone charger. Because when prices spike and shelves go empty, that could be worth more than gold.

Or at least… more than Dogecoin.

Leave a comment